Investment Philosophy

Capitalizing on Economic Tailwinds Through Strategic Multifamily Acquisitions

Market Focus

Stable Park Acquisitions strategically targets emerging markets experiencing significant economic transformation. Our primary focus areas include:

- California's Great Los Angeles Revival with urban revitalization

- Strategic Midwest Manufacturing Reshoring corridors

- Secondary and tertiary markets with strong employment growth

- Areas benefiting from demographic and migration trends

- Markets with favorable regulatory environments

Investment Criteria

We seek value-add multifamily properties that meet our rigorous acquisition standards:

- 10-50 unit multifamily communities

- Properties with proven operational upside potential

- Strong underlying market fundamentals

- Clear value creation opportunities through renovation

- Target IRR of 18-25% with 2.0x+ equity multiple

Value Creation Strategy

Systematic Approach to Maximizing Asset Value

Acquisition

Identify underperforming assets in high-growth markets with strong fundamentals. Focus on properties with clear operational improvements and capital enhancement opportunities.

Enhancement

Implement strategic capital improvements including unit renovations, common area upgrades, and operational efficiency improvements to increase NOI and property value.

Operations

Deploy best-in-class property management practices, implement revenue optimization strategies, and reduce operating expenses through systematic operational improvements.

Exit Strategy

Execute strategic disposition through institutional sale or refinancing to maximize investor returns, typically within 3-5 year hold periods.

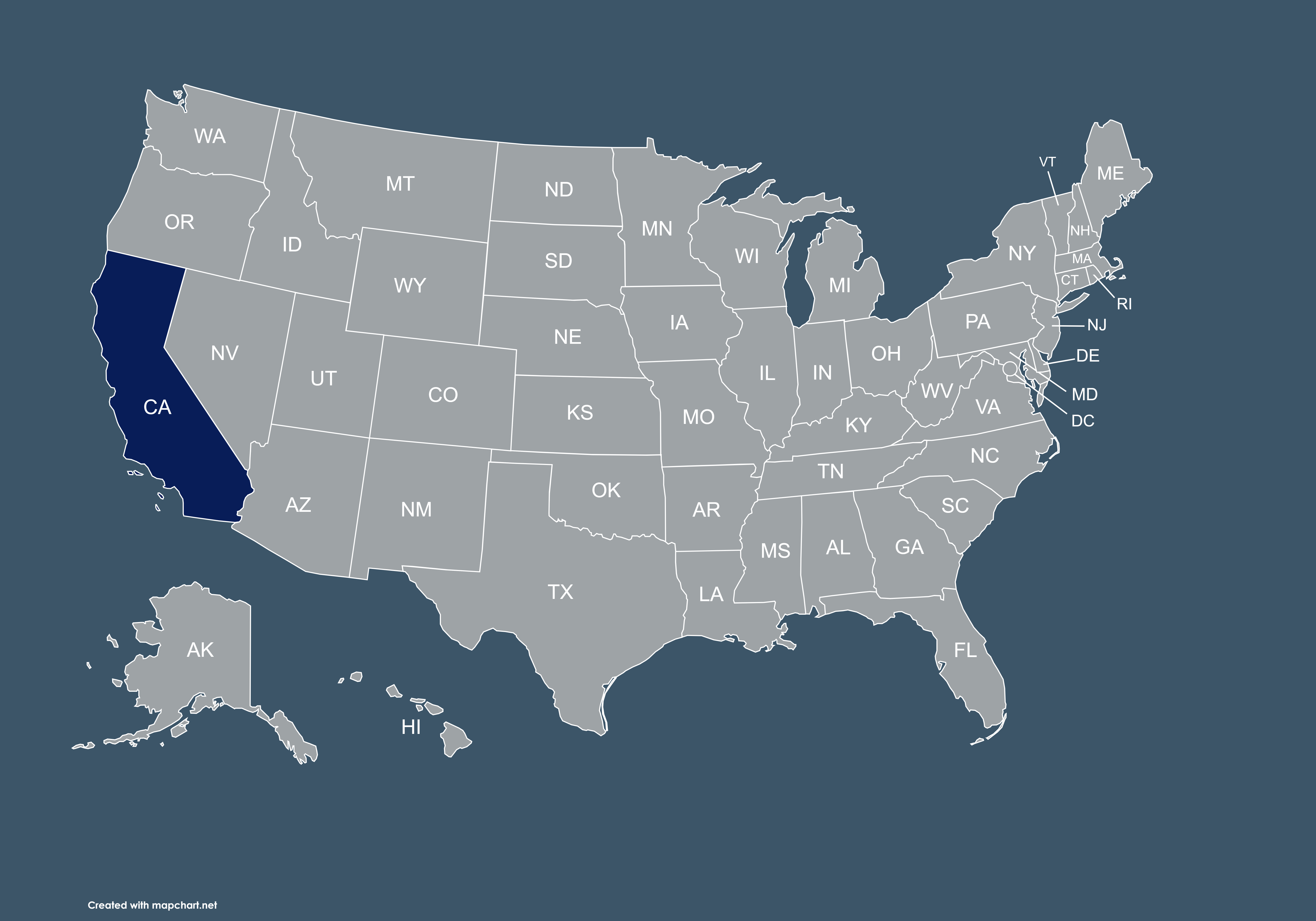

Geographic Strategy

Explore our targeted investment markets across the United States

Market Insights

Real-time intelligence driving our investment decisions

California Market Metrics

Urban development investments exceeding $2.5B annually in California, with 15% job growth in target submarkets. Transit-oriented developments showing 8-12% rental premiums.

Strategic Midwest Growth

New manufacturing facilities bringing 50,000+ jobs to Nebraska, Iowa, Indiana, and Ohio. Housing supply shortage creating 4-6% annual rent growth opportunities.

Demographic Tailwinds

Millennial household formation peak driving 400,000+ new renter households annually in target markets through 2028.

Partner With Us

Explore value-add multifamily investment opportunities with Stable Park Acquisitions